Frequently Asked Questions

1. What is the 50/30/20 budget rule?

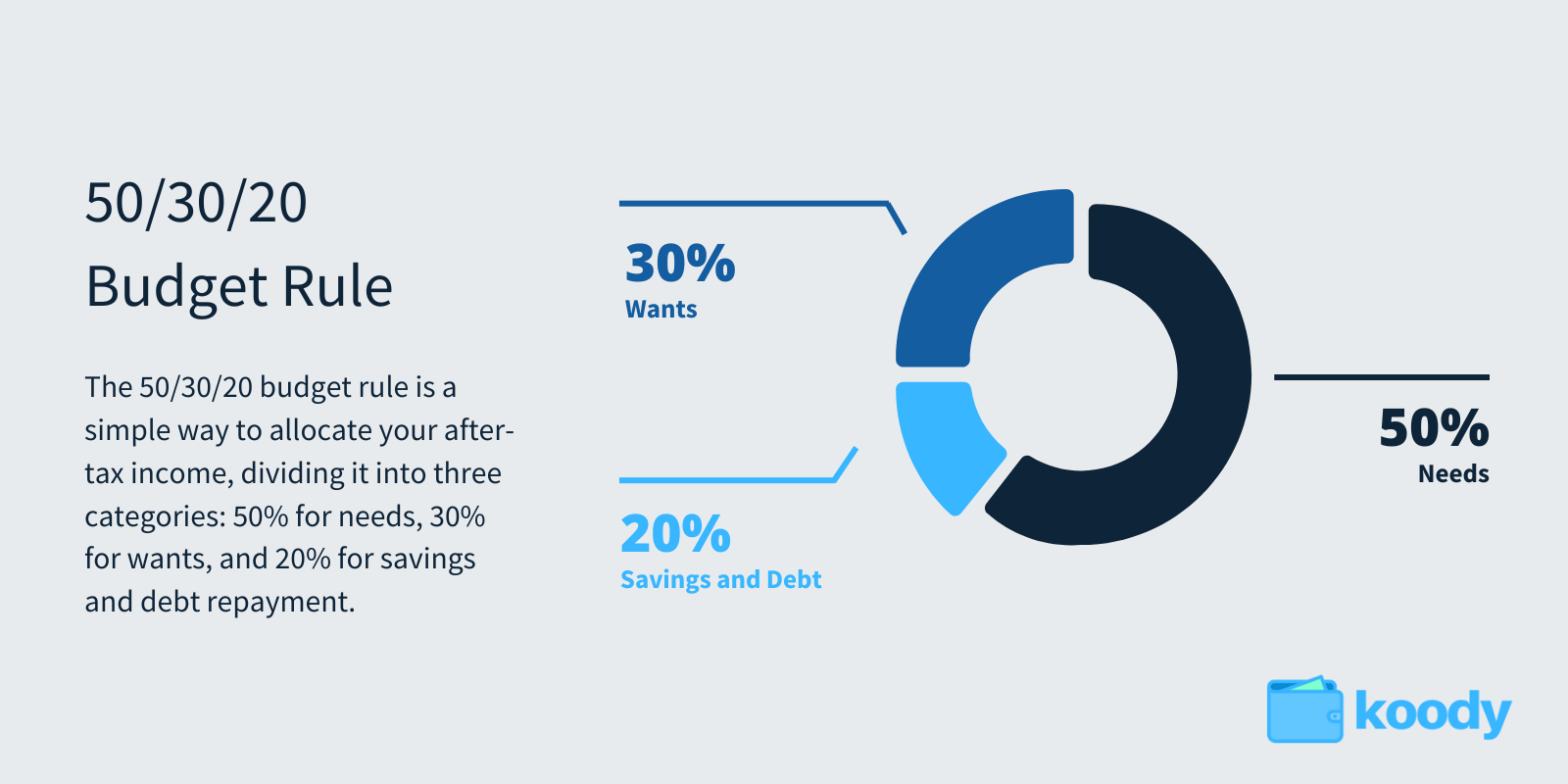

The 50/30/20 budget rule is a simple way to allocate your after-tax income, dividing it into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

2. How does the 50/30/20 budget calculator work?

Our calculator allows you to input your monthly after-tax income and then divides it according to the 50/30/20 rule. It provides you with the amount you should allocate to needs, wants, and savings/debt repayment both on a monthly and annual basis.

3. What expenses are considered 'needs' in the 50/30/20 budget?

'Needs' are essential expenses that you cannot live without, such as rent or mortgage payments, utilities, groceries, transportation, insurance, and healthcare.

4. What are 'wants' in the 50/30/20 budget?

'Wants' are non-essential expenses that enhance your lifestyle, such as dining out, entertainment, hobbies, vacations, and luxury items.

5. How should I categorise my savings and debt payments in the 50/30/20 budget?

Savings and debt payments include contributions to your savings accounts, retirement funds, investments, and payments towards any debts such as credit card bills, student loans, and mortgage overpayment.

6. Can I adjust the percentages in the 50/30/20 budget calculator?

While the 50/30/20 rule is a great starting point, you may adjust the percentages based on your personal financial goals and circumstances. However, our calculator is set to the standard 50/30/20 division to help you get started.

7. Why should I use the 50/30/20 budget rule?

The 50/30/20 budget rule is simple and flexible, making it easy to manage your finances. It helps ensure you cover your essential needs, enjoy your life with discretionary spending, and save for future goals.

8. Is the 50/30/20 budget suitable for everyone?

While it is a helpful guideline, it may not be suitable for everyone, especially if you have significant debt or live in an area with a high cost of living. It is important to tailor your budget to your individual needs and financial situation. For a more comprehensive budgeting and spending tracker app, download Koody or see our list of the best budgeting apps.

9. How often should I review and adjust my 50/30/20 budget?

It is recommended that you review your budget monthly to track your spending and make adjustments as needed. Life changes such as a new job, moving, or major expenses may also require you to revisit your budget.

10. Can this budget calculator help me pay off debt faster?

Yes, by allocating 20% of your income towards savings and debt repayment, you can create a structured plan to pay off debt faster and save money on interest in the long run.

11. Is there a mobile version of the 50/30/20 budget calculator?

Our budget calculator is fully responsive and can be used on mobile devices, ensuring you can manage your budget on the go.

12. How do I get started with the 50/30/20 budget?

Simply enter your monthly after-tax income into the calculator, review the suggested allocations for needs, wants, and savings/debt, and start tracking your spending in each category.